Author

With over 17 years of experience in the Perth property market, Heath Bassett brings a winning attitude to his role as Co-Founder of You&Me Personalised Property Services. A dedicated Defence Force veteran and passionate property investor, Heath thrives on challenges and is committed to securing the best outcomes for his clients. He's known for his honest approach, excellent communication skills, and unwavering dedication to providing a stress-free buying experience.

Did you know that it is quite common for first-time homebuyers to regret their purchase within the first year? Don’t let that be you!

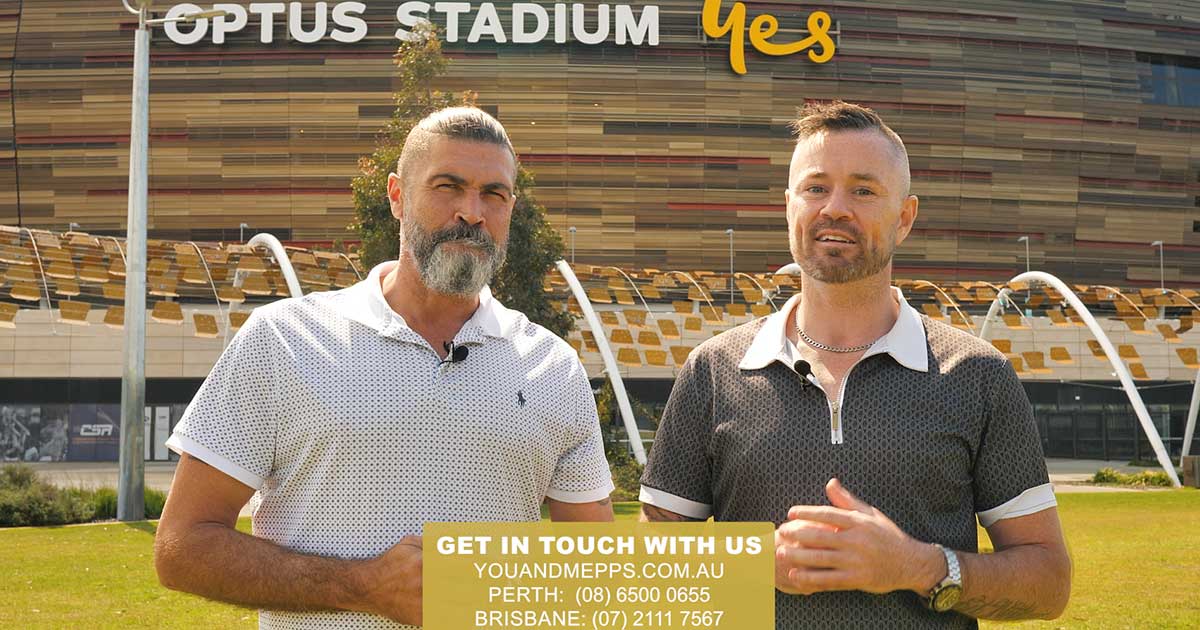

Buying your first home is a long and complicated journey, but it’s also fraught with potential missteps that could cost you a lot. As Simon Deering and Heath Bassett, Perth buyer’s agents and co-founders of You&Me Personalised Property Services, we’ve seen firsthand the challenges that first-time homeowners face in today’s hot real estate market.

With properties being snapped up faster than ever, the pressure to make quick decisions can lead to costly mistakes, mainly if you don’t know what you don’t know.

We want to share some insights to help you understand and be prepared for the challenging process of first-time home buying, helping you avoid the pitfalls that many before you have fallen into.

We will address the most common traps, from dealing with pushy real estate agents to understanding the true value of a property. Let’s explore the pitfalls first-time homeowners should avoid and set you on the path to making a confident, informed decision.

Why First-Time Homeowner Pitfalls Deserve Your Attention

The decision to buy your first home is likely the biggest financial commitment you’ll make in your life. It’s not just about finding a place to live but also about investing in your future, creating stability, and building wealth.

But it is important that you understand that the stakes are high, and the consequences of making mistakes can be severe and long-lasting.

Addressing these pitfalls now is crucial because the real estate market waits for no one. In competitive markets like Perth, where properties are selling at record speeds, hesitation or lack of knowledge can mean missing out on great opportunities or, worse, jumping into a bad deal out of fear of missing out (FOMO).

The cost of not being prepared can be staggering. Financial setbacks, emotional stress, and lost opportunities are just the tip of the iceberg. You might end up overpaying for a property (our Perth buyers agent services will help you with this!), buying in the wrong location, or overlooking critical issues that could turn your dream home into a money pit.

As we share these tips, remember that they’re designed to progress from general advice to more advanced strategies. Let’s start by unmasking the hidden traps waiting for unsuspecting first-time buyers.

Common Pitfalls to Avoid

Don’t Trust Everything Real Estate Agents Tell You

Real estate agents work for the seller, not you. Their primary goal is to sell the property for the highest possible price. Always verify information independently, research comparable sales in the area, and consider hiring a buyer’s agent to represent your interests.

The following is a common scenario: a first-time buyer in Perth was told by an agent that they needed to offer at the top of their budget due to “multiple offers.” After hiring a buyer’s agent, they discovered the property was overpriced and secured it for 15% less than the initial asking price.

Beware of Emotional Decision-Making

Excitement and FOMO can cloud your judgment, leading to hasty decisions. Before you start looking, set clear criteria for your ideal home, stick to your budget no matter how much you love a property, and take time to sleep on major decisions.

It is also common for buyers to fall in love with a home’s aesthetic and rush to put in an offer, only to realise later that the location added an hour to their daily commute, significantly impacting their quality of life.

Don’t Rely Solely on Parents’ Advice

While well-intentioned, your parents’ real estate knowledge may be outdated. Thank your parents for their input, but seek current market information. Consult with professionals who are active in today’s market and use online resources to educate yourself about current trends and prices.

Following her parents’ advice to “always buy the biggest house you can afford,” a first-time buyer maxed out her budget on a large home, only to struggle with maintenance costs and utility bills she hadn’t anticipated.

Advanced Considerations for Savvy First-Time Buyers

Understand the True Value of a Property

The listing price isn’t always indicative of a property’s true value. Learn to calculate the price per square meter for both the house and land. Consider factors like:

- Property age.

- Recent renovations.

- Compare similar properties in the area that have recently sold.

A buyer once noticed that two seemingly identical 3-bedroom homes on the same street had a $100,000 price difference. Upon investigation, they discovered one was on a 400m² lot while the other was on 750m², justifying the price disparity.

Look Beyond the Surface

Don’t be swayed by cosmetic appeal alone. Focus on the bones of the house. Hire a professional building inspector, pay attention to the quality of construction and materials used, and consider future renovation or expansion potential.

A first-time buyer was impressed by a beautifully staged home but later discovered significant structural issues that the fresh paint and new fixtures had hidden, costing them thousands in repairs.

Expert Insights for First-Time Homeowner Success

Understand the Impact of Location Nuances

Micro-location factors can significantly affect property value and livability. Visit the property at different times of day and week, research future development plans for the area, and consider proximity to amenities, transport, and potential noise sources.

We had a client who chose a home on a quiet street, only to discover it became a busy thoroughfare during rush hour, affecting their property’s value and their quality of life.

Plan for the Future, Not Just the Present

Your first home should align with your long-term goals and lifestyle changes. Consider your 5-10 year plan (career changes, family planning, etc.), look at the potential for property value growth in the area, and assess the adaptability of the home to your changing needs.

A young couple might want to acquire a trendy apartment in the city centre, perfect for their current lifestyle. However, they might feel cramped and have to sell at a loss when they decide to start a family, as the space couldn’t accommodate their new needs.

Wrapping Up

Navigating the world of first-time home buying doesn’t have to be a minefield. By being aware of these pitfalls and armed with the right knowledge, you can approach your first home purchase with confidence and clarity.

Remember, it’s not just about finding a house but it’s about making a smart investment in your future.

Take the time to educate yourself, seek professional advice when needed, and always trust your instincts. Don’t let the pressure of a hot market or well-meaning but outdated advice push you into a decision you might regret.

Get in touch with our team of buyers agents

Ready to take the next step in your home-buying journey?

As Simon Deering and Heath Bassett, we at You&Me Personalised Property Services are here to help. Visit our website for more insights, or reach out to our team of experienced buyer’s agents who specialise in helping first-time homeowners make informed decisions. We’re committed to providing you with the cold, hard truth and honest advice to ensure you make the best decision possible.

Remember, in the world of real estate, knowledge truly is power. Until next time, happy investing!

Video Transcript

Property Buyer's Agent and Co-Founder at You&Me Personalised Property Services