Author

With over 28 years of experience in Perth's real estate market, Simon Deering brings his expertise to his role as Co-Founder of You&Me Personalised Property Services. A dedicated family man and passionate property investor, Simon has worked with leading real estate companies and experts throughout Australia. He's committed to providing personalised service and achieving the best outcomes for his clients.

This content has been made available for informational and educational purposes only. For anything specific to your needs or circumstances, please get in contact with us directly.

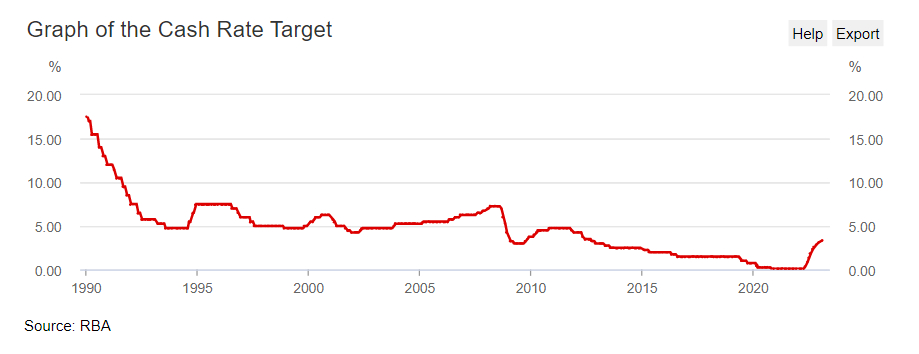

Interest rates rise in February 2023

Hi guys, it’s Simon Deering and Heath Bassett from You&Me Personalised Property Services. Today, guys, we really wanted to talk about probably the most interesting point to talk about in real estate across the country right now: interest rates, and the fact that they’re on the rise and have been, you know, for over 12 months now.

Everyone’s got an opinion on this and depending on who you talk to, will depend on, I guess, the opinion you listen to.

But we really wanted to weigh in on this and put our money where our mouth is. So in saying that, Heath, what do you think interest rates are going to do?

What Heath Bassett think about the interest rates in 2023 (personal opinion, not for financial advice)

3 interest rates rises in 2023

So I’ve been saying since about November that I feel that there’s going to be about three interest rates rises this year. Now, does that mean it’s up until the end of the financial does it mean all year, I’m not sure.

Do you think there’s going to be three interest rate rises before the end of the financial year or you’re talking about for the whole 2023?

Stabilisation to come after 3 rises

Yeah, I feel like the whole 2023. I feel like we’re going to stabilise after three interest rates rises, or it might be four. I don’t know. No one knows, but you think three.

I think three. But prepare for that. So, you know, we’re not here to sugar-coat everything. We’re not here to wrap this up in cotton wool and say: “oh you know everything’s safe”. Prepare for multiple interest rate rises.

Should you save now to increase your borrowing capacity in 6 months?

Okay, so when you’re talking about prepare and I’ll give you my opinion later, but when you’re talking about prepare for interest rate rises. Let’s say I got Mr. and Mrs. Smith, they want to buy a property and they’re saying to us right now: “look, we think in the next six months we can save an extra $20,000 and that is actually going to increase our borrowing capacity from $450,000 to $500,000. That’s what a broker told us”.

So rather than buying the house, we’re going to save for the next six months so they can borrow $500,000, what’s going to happen to that person?

Bank-imposed or self-imposed?

So the first thing I would ask is, are you going to be bank imposed or are you going to be self-imposed? Because we’ve gone through that before (read the article about the different types of property buyers). But basically, you know, self-imposed is the bank telling you that you can borrow 500 but you already spend 450 of that.

Bank imposed means they’ve told you “you can borrow 500”, and so you borrow 500.

So, for this example, let’s just say they are that bank imposed to keep it simple, and they’re going to borrow $500,000.

So right now, today they can get $450,000. I think in six months they can save an extra 20,000 and their broker said that that will correlate into $500,000.

With interest rates going up, the borrowing capacity could decrease

So assuming nothing moves in your job or your expenditures and everything stays the same.

Every single time the interest rate goes up by 0.25%. And I’m not saying the next one is going to be 0.25%. But every time there’s a 0.25% rise in the interest rate, your borrowing capacity goes down around $20,000. So let’s say, I don’t know when the next RBA meeting is. It’s like next Tuesday, let’s say next Tuesday the RBA goes right, we’re going to increase the cash rate.

(And considering this video won’t be put out today, next Tuesday could be last Tuesday when you’re watching this.)

For every 0.25% rate increase equals borrowing capacity down $20,000

So, let’s say that they go, we’re going to increase by 0.25%. My question to the viewers at home is you’re trying to save money to increase borrowing capacity, but can you save $20,000 between last week and now? It’s Wednesday, the 1st of February to next Tuesday?

We know the answer: most likely no.

So effectively, this client that wants to save for six months to get the extra 20 grand runs the risk of let’s just say there’s three strike runs, the risk of actually reducing their borrowing capacity by $60,000 if they think to save the next $20,000, they’ve lost $60,000 on their borrowing capacity. So they may end up around $450,000 borrowing capacity. So it may even be less.

Should you wait another 6 months?

It should be less. But if they could save the 20 grand. So there’s things that you’re offsetting against. But the point I’m trying to make is why? Why are you waiting for six months?

Now let’s use a real example. The real example was we had clients last year that were going to come on board and they didn’t because they thought they could save an extra $20,000 to get the extra money.

We are professional buyer’s agents

Now, because we’ve had the rate rises that we’ve had, they are on board with this, but they are looking at a lower purchase than what they could have done six months ago. So, guys, we don’t sell anything. We don’t have products that we sell. We help buyers. Buyers employ us to legally represent them and do what’s best for them.

Perth is a great choice for property investors

If you’re looking at investing in buying property, what’s best for you now is to get into the market, get into a market that’s sustainable and viable. In our experience, from what we’re saying, Perth is without doubt the most sustainable and viable market in the country right now.

And can you tell us why?

- Employment, unemployment

- That’s the highest rental yield

- Lowest rental vacancy

- Everything in this state is viable and sustainable

- The average income here in Perth is very similar to what average incomes are over in New South Wales, Queensland and Victoria, but properties are more affordable

Most affordable capital city in the whole of Australia, all we’ve got all the resources. Immigrant numbers are meant to be, statistically speaking, 40,000 people a year up until 2030 or 2031.

Even more reasons to choose Perth when buying or investing in real estate:

- Immigrations

- Resources

- Lithium deposit that’s that will be turning into a mine at some point

- More jobs

Largest lithium deposit in the whole world, that was found probably 18 months two years ago. But obviously, as you know, things take time.

Do you think that our awesome coastline, like Yanchep is joining civilization this year You know, there’s no ifs or buts.

Property prices in Perth have gone up since 2022

Let’s just be real we bought last year in Clarkson in for $430,000 a 4 bedroom 2, 600 square meters.

For the same property, today (February 2023), you’re not going to get that under $500,000.

A client of ours who bought last year, not only was he protected by rent returns, but he’s just gained over $70,000 in about a year. Just under a year.

Like all our clients did in 2022.

What Simon Deering thinks about the interest rates in 2023 (personal opinion, not for financial advice)

So, what do I think? Well, I think that between now and the end of the financial year, we’re going to have two more interest rate rises.

And I think, you know, from 1st of July, things are going to taper out even now and a lot more confidence is going to come back into the market, particularly in Perth. I think New South Wales and Victoria have got a long way to go. I think Brisbane and Queensland will also flatten out or stabilise.

Well, let’s talk about Queensland: they’ve just come off their biggest drop.

Yes, over the 2020-2021 period, and we’re talking averages here, things change on the ground as we know. But you know, they had a 43% increase over this period and they’ve just dropped 10%.

And again, you know, we’re talking about major stats, you know, so, is that 10% coming off the top value, is that low value still growing.

What you’re saying is yes, 100% is coming off the top end like it does in most markets. But a lot of their lower range opportunities have sort of just plateaued.

Because people are looking for confidence, they’re looking for stability and the rental market isn’t quite as strong in Brisbane. When I say rental market, I mean the, the vacancy value, the yield.

Buy an investment property with $500,000 right now (February 2023)

So it’s like if I put $500,000 into an investment property right now:

- What property do I get in what state

- What return I get

What type of property can you buy in Sydney?

So, $500,000 into Sydney, you get the studio apartment, you might get half a studio apartment, a letterbox and you’ll get a rental of, I don’t know, maybe $350, $400 per week.

The rental yields are getting closer: 3%-3.4% sort of on average.

What type of property in Brisbane?

In Brisbane I can get a 2-bedroom apartment.

What can buyers get in Victoria for $500,000?

In Victoria, a buyer could maybe get a one bedroom apartment

Do you have $500,000 to invest in property? Why not consider Perth?

In Perth, with $500,000, you can get:

- a house

- 4 bedrooms and 2 bathrooms

- 500 square meters of land

- 30 minutes from the city

- 5 minutes from the beach

Perth offers great opportunities for property buyers

Everything that’s coming out of the Perth market right now represents confidence to me. And I love buying an investment property based on worst case scenario.

So, if I was buying an investment property right now, you know, fix yourself for 4 interest rate increase: buy that property on 4 interest rate rises.

Buy that property on the fact that you’re not going to get a tenant in there for four weeks, even though at 0.5% vacancy rate, which means you should have a tenant on settlement.

Let’s say you’re not going to get it for four weeks and let’s just say that you’re not going to get 5.5% rental yield, you’re going to get 4% rental yield.

What are you waiting for?

That’s all those numbers still add up. What are you waiting for? You should be buying property. Engage with a professional team that you trust and go and get your property. Build that portfolio. Don’t wait for tomorrow. Tomorrow never comes.

Get in touch with us for more information

So if you’ve got any questions all about the Perth property market, real estate in general, give us a call. Text message, Email, we’re always available.

Find out more about our buyer’s agent services.

But until next time, happy investing.

Buyer's Agent, Co-Founder at You&Me Personalised Property Services